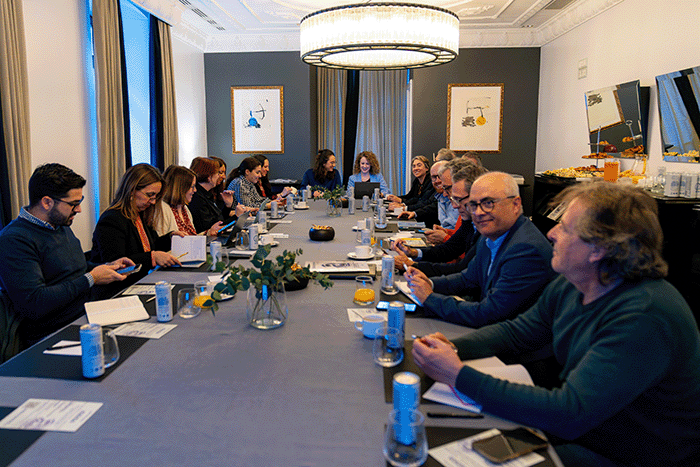

The 2025 edition of the TIA OTR Tire Conference, held this year at the Sheraton Resort & Casino in San Juan, Puerto Rico offered, on the face of it, very much the same as it did in previous years, the conference structure was much the same as always with many of the same speakers talking about the same topics as last year. But this year’s event was notable not so much for the subject matter of the conference, but for the overwhelming feeling of uncertainty as to what President Trump’s new administration is going to say and do next, especially with relation to tariffs and immigration and how that is going to impact on the economy in the United States in general and both the OTR tyre and retreading sectors in particular.

Impact of New Administration a Key Talking Point

Let us be clear, the main reason that people attend the TIA OTR Tire Conference is for the exceptional networking opportunities that it offers. I can honestly say that I can’t think of any other tyre industry event anywhere in the world where the participants and sponsors get so much out of their presence there.

The event runs on a tried and tested formula – technical workshops on the first day, economic information on day 2 followed by an early finish (10.30 am!) so that every can go any play golf or participate in a variety of other social activities, day 3 is a mix of more general economic info combined with motivational speakers as well as several breakout sessions – all interspersed with table top networking sessions – and that is the crux of this event. It offers a true community feel as well as real value from the meetings and connections people are able to have at the show.

Indeed, TIA CEO Dick Gust opened the event to the announcement that the 2025 conference had attracted 500 attendees from 35 states and 12 countries of which 20% were first time attendees. There were also 84 sponsors in total, who contributed to a feel that the networking area was larger than it has been in recent times. With conferences like this, the proof of the pudding is whether people come away feeling that their investment in the event was worthwhile, and from the people I spoke to, that was certainly the case once again this year.

Economic Uncertainty Prevails

One of the main takeaways from the conference was a feeling of uncertainty caused by the incoming Trump administration and a sense that many market players were holding back on investments until it becomes clear. The question of tariffs, of course was a major talking point, and there was a variety of opinions on how the new government’s policies might affect the market.

Given the potential for Mexican businesses to have tariffs forced upon them, one of the first companies we spoke to was Pre-Q Galgo, which has considerable business in the US market. We found Eduardo Nava in a “que sera, sera” mood, pointing out that he wasn’t sure what would happen if the US imposed tariffs on Mexican goods, but they would have to deal with it if it did.

As far as Canada is concerned, it was impossible not to become acutely aware of Canadian feelings towards the new administration in Carol Hochu’s presentation on the Canadian Economy. The President and CEO of TRAC was as civil and diplomatic as she could be speaking to an American audience, but her feelings were clear when she quoted the well-known statement by John F Kennedy on US Canadian relations: “Geography has made us neighbours. History has made us friends. Economics has made us partners. And necessity has made us allies. Those whom nature hath so joined, let no man put asunder.”

As far as equipment suppliers were concerned, the response was mixed. Edd Burleson from Central Marketing, who imports equipment from Europe, expressed concern about import tariffs. Daniel Zeledon from Tesco-Italmatic, on the other hand, expressed the view that import tariffs on new OTR tyres would lead to an increase in demand for OTR retreads and that plants would need to invest in robotics to meet the extra demand.

TIA Provides Political and Economic Forecasts

On the second day of the OTR Tire Conference each year, TIA, by tradition, provides political and economic forecasts for the coming year.

According to Roy Littlefield IV, TIA’s Vice President of Government Affairs, the new administration’s priorities were focused on the Department of Government Efficiency, cutbacks to the Federal Work Force, and the use of tariffs and border protection as negotiating tools. For TIA, the key issues were taxes, infrastructure regulations and energy.

Said Littlefield: “We would like to see the 2017 tax cuts made permanent, an increase in infrastructure projects, a reduction in regulatory burdens, the expansion of energy production, and increased support for construction and mining.”

The US Construction and Mining Forecast, meanwhile, was presented by TIA’s Chief Technical Officer Kevin Rohlwing. The overwhelming takeaway from Rohlwing’s presentation was the disparity in forecasts between the various consultancy specialists in the sector.

ConstructConnect, he pointed out, were forecasting an 8.5% growth in construction in 2025, with residential expanding as much as by 12%, drivers for the growth being falling interest rates, power generation and infrastructure projects (e.g. data centres), and commercial real estate lending.

Edzarenski.com, meanwhile, were forecasting only a 3% growth in 2025 compared with 6% in 2024. “With little consensus on market prospects,” pointed out Rohlwing, “my thoughts are it will probably relatively stagnant in 2025. The truth is, nobody knows,” he added, a sentiment he repeated several times in his presentation.

According to Rohlwing, there were several key factors which can be expected to affect the market. Firstly, figures were showing an increase in spending, but this was much fuelled by inflation. Meanwhile, the interest rates were slowing down people wanting to sell residential properties, hence affecting construction.

Tariffs could also impact construction, he added, affecting the import of lumber from Canada, cement and gypsum from Mexico and furniture, plastics and electronics from China. Immigration policy would also affect the US workforce as an estimated one in eight construction worker are undocumented, he explained.

Overall, Rohlwing’s conclusion was that the market will depend on interest rates and inflation, an if this doesn’t come down construction will suffer.

Incidentally, as a counter to this, in one of the breakout sessions, Daniel Zeledon showed figures from a report from Research and Markets which showed a forecast for the US OTR tyre market to rise from 2.89 to 4.17 billion between 2023 and 2029.

Too Early for Conclusions

Clearly, of course, with the conference taking place only a month into Trump’s presidency, it was far too early to make a judgement over what the impact of government policy will be. It will certainly be interesting to find out at TIA’s 2026 OTR Conference, which will take place next year at Rosen Creek in Orlando, Florida.