Page 16 - RB-81-17-2

P. 16

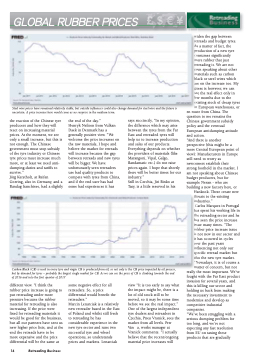

GLOBAL RUBBER PRICES

Steel wire prices have remained relatively stable, but outside influences could also change demand for steel wire and the future is uncertain. A price increase here would come as no surprise in the medium term.

widen the gap between retreads and budget tyres. As a matter of fact, the production of a new tyre consumes significantly more rubber that just retreading it. We are not even speaking about other materials such as carbon black or steel wires which are on the increase too. My guess is however, we can see the real effect only in few months due to the existing stock of cheap tyres in European warehouses, or

en route from China. The question to me remains the Chinese government subsidy policy and the eventual European antidumping attitude and action.

“And there is another perspective (this might be a more Central European point of view): Manufacturers in Europe still need to worry as newcomers establish their strong foothold in the market. I am not speaking about Chinese budget producers, but for example Nexen - who are building a new factory here, or

Hankook. These create new threats to the existing industries.”

Carlos Marques in Portugal has spent his working life in the retreading sector and he has seen the price increase issue many times. “The rubber price increase issue is not new in our sector and it has occurred in cycles over the past years influencing not only our specific retread market but also the new tyre market. “Nowadays, it is of course a matter of concern, but not

really the most important. We’ve fought with the Far East product invasion for several years, and this is killing our sector and holding us back from making the necessary investment to modernise and develop as competitive industrial companies.

“We’ve been struggling with a serious dumping problem for too long, and we’re not expecting any fast resolution from EU on taxing these products that are gradually

the reaction of the Chinese tyre producers and how they will react on increasing material prices. At the moment, we see only a small increase, but this is not enough. The Chinese government must stop subsidy of the tyre industry or Chinese tyre prices must increase much more, or at least we need anti- dumping-duties and tariffs to survive.”

Jörg Kerstholt, at Reifen Goering, also in Germany, and a Bandag franchisee, had a slightly

the end of the day.”

Henryk Neilson from Vulkan Daek in Denmark has a generally positive view. “We welcome the price increases on the raw materials, I hope and believe the market for retreads will increase because the gap between retreads and new tyres will be bigger. We have unfortunately seen retreaders use bad quality products to compete with tyres from China, and if the end user has had some bad experiences it has

says succinctly, “In my opinion, the difference which may arise between the tyres from the Far East and retreaded tyres will help us to increase production and sales of our products. Everything depends on whether the providers of materials (like Marangoni, Vipal, Galgo, Bandamatic etc.) do not raise prices again. I hope that shortly there will be better times for our industr y.”

Still in Czechia, Jiri Binko at Tasy, is a little reserved in his

Carbon Black (CB) is used in every tyre and virgin CB is produced from oil, so not only is the CB price impacted by oil process, but by demand for tyres – probably the largest single market for CB. As we can see the price of CB is climbing towards the end of 2016 and into the first quarter of 2017

different view. “I think the rubber price increase is going to put retreading under more pressure because the rubber material for retreading is also increasing. If the price were fixed for retreading materials it would be good for the business, but all our partners have sent us new higher price lists, and at the end the retreads have to be more expensive and the price differential will be the same at

some negative effect for all retreaders. So, a price differential would benefit the retreaders.”

Marcin Lenarciak is a relatively new retreader based in the East of Poland and whilst still fresh to retreading he has considerable experience in the new tyre sector and runs two successful tyre and wheel operations, so understands prices and markets. Lenarciak

view “It is too early to say what the impact might be, there is a lot of old stock still to be moved, so it may be some time before we see the real impact.” One of the largest independent tyre dealers and retreaders in Czechia, Pneu Vranick, sees the market from all levels. Petr

Van a, works manager at Vranick comments. “I actually believe that the recent/ongoing material price increases will

16 Retreading Business